Amazon & FTX/Gemini: Why one succeeded over the other

An analysis on the similarities & where they stop, & what generational ideas are made of

Most revolutionary technology companies’ successes are built on top of a multitude of smaller but equally important triumphs. Positive unit economics at scale, contagious network effects & a incessant urge to build the best product there can be. But if we were to peel back the layers, these companies were once startups, & these startups were once ideas. & in my truly humble opinion (I am very open for debate here), there are really 2 main determinants underpinning generational & groundbreaking ideas in tech. A discerning insight about a particular space/problem, & a heretic belief on what the potential market is going to be like, also particularly in that order.

If you were to take a look at Apple’s founding story, it is easy to see that the Steves’ (Jobs & Wozniak) insight that the UI of mainframe/minicomputers was just terrible. Together with the belief that PCs are bound to be mainstream, this led them to the creation of Apple 1 & subsequently the Mac. But in order to fully appreciate what I mean, we should look into a sector that took the world by storm over the past 25-ish years or so, e-commerce. & we cannot speak of e-commerce without analyzing one of the OGs in the space, Amazon.

Amazon was founded by none other than Jeff Bezos, & undoubtedly a true pioneer in leveraging the internet for commerce. But way back in 1995, it was for sure not as obvious, & may even be more expensive to run vs a retail location. But Bezos & the early Amazon team had a sharp & nuanced insight, that commerce over the internet enabled a negative operating cycle.

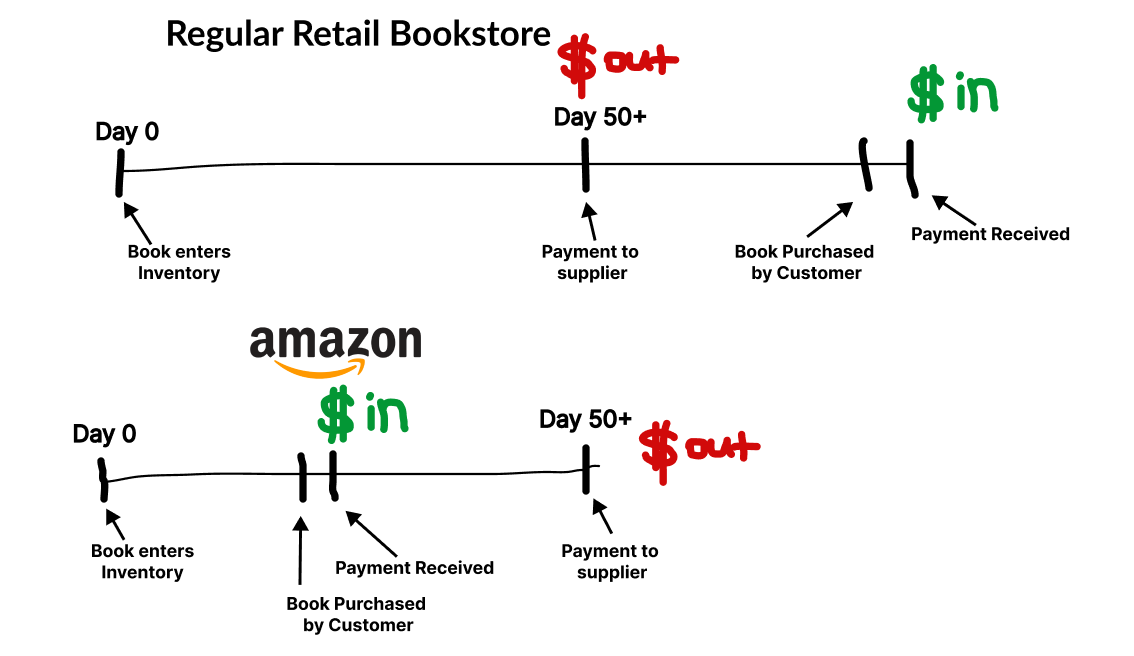

Everyone knows how it works for a traditional retail book store. They buy books before selling them. A book that is shipped from the distributor to the store on Day 0 will be paid by the store 2+ months later (for reasons such as ensuring seller liability on low-quality books). The book sits in inventory during this period till a customer buys it. The bookstore gets a nice margin on selling the book & continues operating for another day. Customer gets her book, bookstore makes a profit. Yay? not quite. As the bookstore typically has to pay the supplier before customers pay, they need a method of financing that “cash out” without the “cash in” of the very book that is going to be sold. This money can come from their own balance sheet or even debt, but this need to continuously finance this gap disallows the bookstore from using that cash to invest & improve their offering. Be it getting a larger range of books or even opening a second location.

& this is where Amazon & Jeff’s discerning insight kicks in. With the power of the internet & the interconnectivity it can bring, an “online bookstore” can flip the model on its head. The book arrives in inventory on Day 0. Now, with the internet, a customer can purchase the book online when its stock updates on Amazon.com, which is way more “on demand” vs a traditional retailer. Their credit card then gets charged almost immediately. However, same as with the retail bookstore, distributors only settled with Amazon every few months or so. This means that there are sales dollars, sitting in Amazon’s bank account, waiting to be paid to suppliers some time in the future.

If Amazon is confident that it will be able to pay suppliers on Day 50+, then these sales dollars in the form of book costs & margin, are effectively interest-free financing vehicles for them. Amazon can then invest in more distribution centers & get books to customers faster, increasing more of this “cash float” available that they can reinvest once again. a flywheel is attained. This was Jeff & his management team’s discerning insight.

But if you think about it deeply, Amazon has to be right about being able to pay suppliers on Day 50+. Because if they were wrong, they are illiquid. They would have “borrowed from the future” & not be able to pay it back in time. & if I were to put myself in Jeff’s shoes almost 30 years ago, right when the internet bubble was bursting, I doubt I would have that much faith in a novel business model. Which is why Jeff & his team also needed & had a heretic belief, that internet technology will be able to pull through the upcoming dotcom bubble & continue to deliver consumer value & grow. & they were pretty damn right about that. That growth on Amazon led to them having more “float” & more dollars leftover when they had to pay suppliers, allowing them to reinvest it back into the company.

While Amazon is of course a shining example of what I mean by generation-defining ideas requiring a discerning insight & a heretic belief, I can’t help but to reflect on the recent FTX/Gemini fiascos & how they could have almost been right.

From a high-level, skyscraper-tall level perspective, their insight was that crypto enabled a “better” business model. With the creation of its own FTT tokens, FTX basically created something “of value” at essentially zero cost, a 100% gross margin business! & with Gemini, they knew that consumers in peak crypto bull season were chasing the highest yields. & since they knew that they could lend it to trading firms such as Genesis at an “assured” 10%, they decided to give Gemini Earn users 8% yields on their deposits, netting the 2% in fees by just being a middleman. & all this sounds great but this is where their underlying belief was wrong, they believed that crypto markets will continue to “moon” indefinitely. & with all bubbles, they eventually burst. Crypto markets imploded & many funds/firms went bankrupt. Alameda suffered heavy losses which led to FTT’s price tanking & subsequently FTX’s downfall, Gemini stopped withdrawals for their Earn customers when Genesis suspended redemptions. This belief they had that “number will always go up” got ripped apart & they are now facing the price.

But imagine if “number did go up”, would any of this surface? FTX/Gemini could still be “right”. & bringing it back to Amazon, what if Jeff & the team was not right about the internet? Would they have been the “dotcom bubble’s FTX”?